Muhammad Ali Memon is a graduate of NUST. He is keenly interested in studying the changing paradigm of global power politics. He is a writer and student of international relations and global politics.

Build Back Better World (B3W)

At a G7 summit in June 2021, the West set out its plan with a spiffy abbreviation – B3W (Build Back Better World). It pitches B3W as a “values-driven, high-standard, and transparent infrastructure partnership led by major democracies”. The acclaimed hallmark of the Build Back Better World is its economic viability, alignment with the Paris Agreement, environmental and social sustainability, and compliance with international standards, laws, and regulations.

Moreover, it is the largest (on-paper) investment project in the history of the modern world, accounting for a $40 trillion global infrastructure initiative focusing on climate health, health security, digital technology, gender equality, market development, and clean energy. The initiative manifests the Blue Dot Network, which aims to create a global network through lending-based financing to build roads, bridges, airports, ports, and power plants.

Out of the total investment of $40 trillion, the first phase will incorporate $7 trillion by 2035. Keeping in mind the economic size of B3W countries, ceteris paribus, it can undermine China’s Belt and Road Initiative (BRI) in Asia, Africa, and the Middle East, but not in the foreseeable future.

BRI: Xi’s Proactive Plan

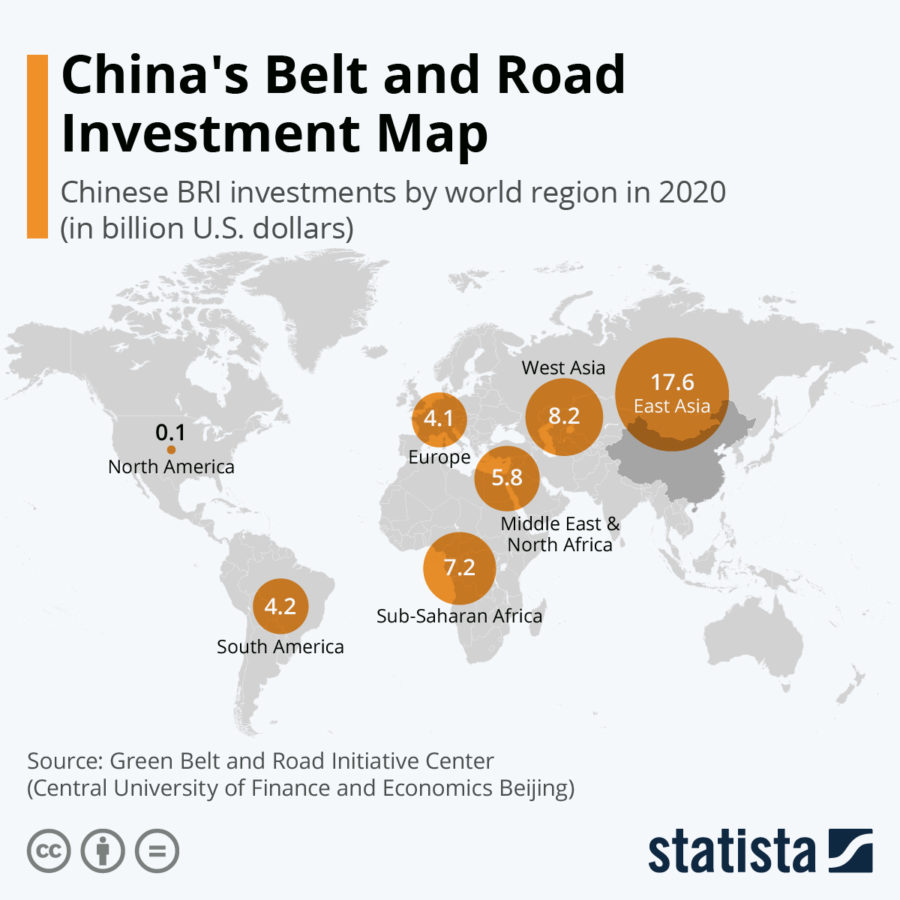

The Belt and Road Initiative (BRI) is a transcontinental long-term policy-oriented investment program, unveiled in 2013 by China’s President Xi Jinping. Until 2016, it was known as OBOR (One Belt One Road). According to BRI’s official outline, its main aim is to link Asia, Europe, and Africa by setting up all-dimensional, multi-tiered, and composite connectivity networks, consisting of land (Road) and sea (Belt) routes, to realize diversified, independent, balanced, and sustainable development in the BRI countries.

The Belt and Road Initiative comprises 2,600 projects with a combined value of $3.7 trillion, spanning 140 countries that encapsulate 40% of the world’s population and together represent more than a third of the world’s GDP. The mega project combines two initiatives:

- The land-based Silk Road economic belt, comprising of 6 development corridors (CPEC is one of them)

- The 21st century maritime silk road.

Intergovernmental policy coordination, unimpeded trade, facilities connectivity, financial integration coupled with collective economic growth, and people-to-people bonds are the proclaimed goals of the BRI. It is the most expensive and extensive operational infrastructure project in history. The investment is predominantly in the energy sector, oil and gas sector, special economic zones (SEZs), and agriculture.

Through BRI, China aims to achieve quicker and shorter access to the market, establish an alternative trade route system for the world and itself, the development of western China, collective regional economic growth, reduce its dependency on the West, and widen the sphere of its political clout through economic diplomacy coupled with the socio-cultural expansion of Confucianism.

Through BRI, China is trying to create a “web of interdependence”; once states get trapped in China’s dependency syndrome, there is a leveraging geostrategic-cum-geopolitical impact. To the West’s disliking, China is exporting its version of economic development contrary to the West’s vision through democratic reforms.

BRI vs B3W: Will They Contradict Each Other?

In the BRI vs B3W rivalry, the former’s paramount focus is on infrastructure development and economic connectivity through reliable sea and land trade routes. The Build Back Better World (B3W), however, focuses on the Human Development Index-based investments, such as in education, health, and women’s development programs.

Economic power projection, through aid and foreign investments, aligns with America’s Hamiltonian diplomatic vision—inspired by Alexander Hamilton. It vies to see the US progress as an economic power, contrary to the Jacksonian notion of focusing only on military might.

On the other hand, the Chinese dragon (BRI) manifests the moral principle of “peaceful rise and development“, which denies realist solutions and has a liberal pursuit vis-à-vis any contemporary issue, envisaging collective growth through win-win politics. Although both the initiatives fall in line with their respective manifestoes, what gives BRI an upper edge is its tangible operational existence vis-à-vis the B3W’s mere “on paper” existence without even a detailed financial-cum-operational plan.

The rising rivalry between the two economic giants, in the form of BRI vs B3W, will provide more opportunities and diversified options for developing countries. The USA and the West will have to realize that it will not be possible for countries to roll back BRI owing to long-term binding deals with the Chinese government.

Eventually, both parties will have to be content with competitive co-existence in the global arena. Once the BRI and the B3W start to complement – rather than contradict – each other, much-needed contours of economic partnerships will unlock, envisaging a win-win situation for the US, China, and their respective allies.

Entrenched Dependency Syndrome

In the comparison of BRI vs B3W, what is analogous between the BRI and the B3W is that both are predominantly loan-based projects. Although BRI has a portion of foreign direct investments (FDIs) and the BOT (Build-operate-transfer) model projects, B3W will incorporate some aid but loans at commercial rates will constitute a significant chunk of the total investments.

That’s where the problem starts, and the developing bloc needs to sit back and ponder over it before getting entangled in a vicious cycle of economic dependence. The BRI has faced harsh criticism from the United States, which considers the initiative akin to economic imperialism. However, the subsequent announcement of B3W will also bring the US under the sardonic eye of investment analysts.

The loans might give China and the US too much power and influence over the countries they help financially. The states might opt for unsustainable loans to pursue these infrastructure projects. Subsequently, when the countries experience financial quandary, China and US will have the leverage to extend their political and strategic clout, compromising upon the indebted states’ sovereignty and making them vulnerable to exploitation.

This concept is in line with economic imperialism. Its practice is known as neo-colonialism and is based upon a dependent state’s monetary and political control, leaving it with no other rational choice but to align its domestic and foreign policy with the lender’s interest to the detriment of its national interest. The critiques label it as “debt-trap diplomacy.”

Moreover, the loan agreements under the umbrella of the BRI include security provisions, such as the “cross-default clause” and the “stabilization clause”. To be at a competitive par with China in mustering geostrategic, geo-economic, and geopolitical gains, the B3W might also include such clauses that turn into a nightmare for dependent states.

The cross-default clause will imply that if a state defaults on its BRI loan, it will automatically default on B3W’s loans, giving the lenders a right to demand immediate debt payment. On the other hand, the stabilization clause shields foreign investors from political risks and subsequent adverse legislative or regulatory changes in host states by making any new laws inapplicable to the investment project.

The foreseeable harmony of interest between the stakeholders of the Belt and Road Initiative and the Build Back Better World (B3W) project might entangle the developing world further into the complexly woven fabric of dependency. Higher the dependence, higher the vulnerability, and higher the imperial outreach of powerful states.

If you want to submit your articles and/or research papers, please check the Submissions page.

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.