Ms. Palwasha Khan is a student of International Relations at the National Defence University Islamabad.

A Burdensome Crisis

Lebanon has been propelled by tumultuous crises, notably the fiscal and financial crisis. As per the reports of the World Bank Lebanon Economic Monitor of Spring 2021 (LEM), the crisis is likely to rank in the top 10, possibly the most severe crisis episode globally since the mid-19th century.

Dreadful and prolonged financial recession, challenges on the political front, the ineffectiveness of the government, lack of a viable executive authority, and a debt mountain have taken the country by swirl. The outbreak of COVID-19 has further augmented the cascading crises resulting in costing many people’s lives and livelihoods.

The Underlying Causes

Prior to the emergence of the noxious COVID-19 and the explosion at the Port of Beirut in 2020, Lebanon had already been grappling with a wrenching economic crisis after successive governments piled up debt following the 15-year civil war with nothing to pay in return. As of 2021, the debt mountain in Lebanon is equivalent to 167% of the country’s output, making it a burdensome economic crisis.

Following the end of the civil war, Lebanon balanced its finances with foreign aid, revenues from the tourism sector and financial industry, and the Gulf Arab state’s benevolence, boosting central bank reserves to finance the country. Most importantly, remittances from the millions of Lebanese living and working abroad was one of its most reliable sources of inflow of dollars; despite 2008’s financial crisis, they sent money.

However, remittances started slowing down from 2011 as a result of sectarian wrangling, which led to more political instability in Lebanon, and most parts of the Middle East, particularly Syria, that fell into turmoil. With Iran’s growing influence in Lebanon through Hezbollah, the Sunni-Muslim dominant Gulf states began to turn their backs on Lebanon.

As transfers failed to match imported goods and commodities, the budget deficit soared, and the balance of payments sank deeper into the red. It was until 2016 that banks began offering exceptional interest rates for new deposits of dollars and even higher rates on Lebanese pound deposits.

Lebanon’s economy was confronted with extraordinary challenges by October 2019. The country was politically adrift, as there was no president between 2014 and 2016, accelerating the political downfall of the country. There were many protracted delays in cabinet formation, and the 2018 parliamentary elections were held after a five-year hiatus.

The Hariri administration, which was in power at the time, became inert, unable to deliver on any of the changes necessary as a condition for foreign assistance. The local population was outraged by the political class’s incompetence and inaction; a swarm of people took to the streets and demanded radical political change.

In response, the cabinet resigned, causing political turmoil in Lebanon. As expected, capital inflows ceased abruptly, and banks that were already bankrupt faced a serious liquidity crisis. Lebanese lira devalued rapidly, leading to soaring inflation that, in turn, plummeted people’s wages and purchasing power.

Financial State

Lebanon’s banking sector imposed stringent capital controls, withdrew lending, and refused to accept deposits. It, however, endured in a segmented payment structure that distinguished between older dollar deposits (pre-October 2019) and the limited influx of “fresh dollars”.

De facto “lirafication” and cuts caused a severe deleveraging of the former. Therefore, the burden of adjustment and deleveraging proofed to be extremely regressive, with a minute number of depositors and Small and Medium Enterprises (SMEs) facing dire consequences. Lebanese lira depreciated as inflation surged, affecting the poor and middle classes the most.

The economic collapse and emergence of COVID-19 resulted in the decimation of one of the largest sectors of Lebanon’s economy, the tourism sector. As a result, the living conditions of millions of impoverished people have deteriorated. Even before the pandemic, many businesses were forced to close due to public debt defaults and a financial liquidity crisis.

Lebanon dealt with the pandemic by implementing smart lockdowns and other various measures to curtail the effect of the virus on both individuals and the shaky health system. As per the National COVID-19 Deployment and Vaccination Plan, vaccination progressed throughout the country with initial funding from the World Bank. The aim is to vaccinate around 70 per cent of the entire population in a multi-phase rollout of citizens and non-citizens before the end of 2022.

While Lebanon was dealing with the pandemic, World Bank estimated that real GDP would shrink by 20.3 per cent in 2020, after contracting by 6.7 per cent in 2019. Lebanon’s GDP plunged from about US$55 billion in 2018 to a projected US$20.5 billion in 2021; the real GDP per capita plunged by 40 per cent in terms of dollars.

The exchange rate depreciated by 68 per cent to LBP 19,800/US$ between March and August 2021, compared to an 18% depreciation during the preceding six months. The effect on pricing resulted in soaring inflation, an average of 131.9 per cent in the first six months of 2021.

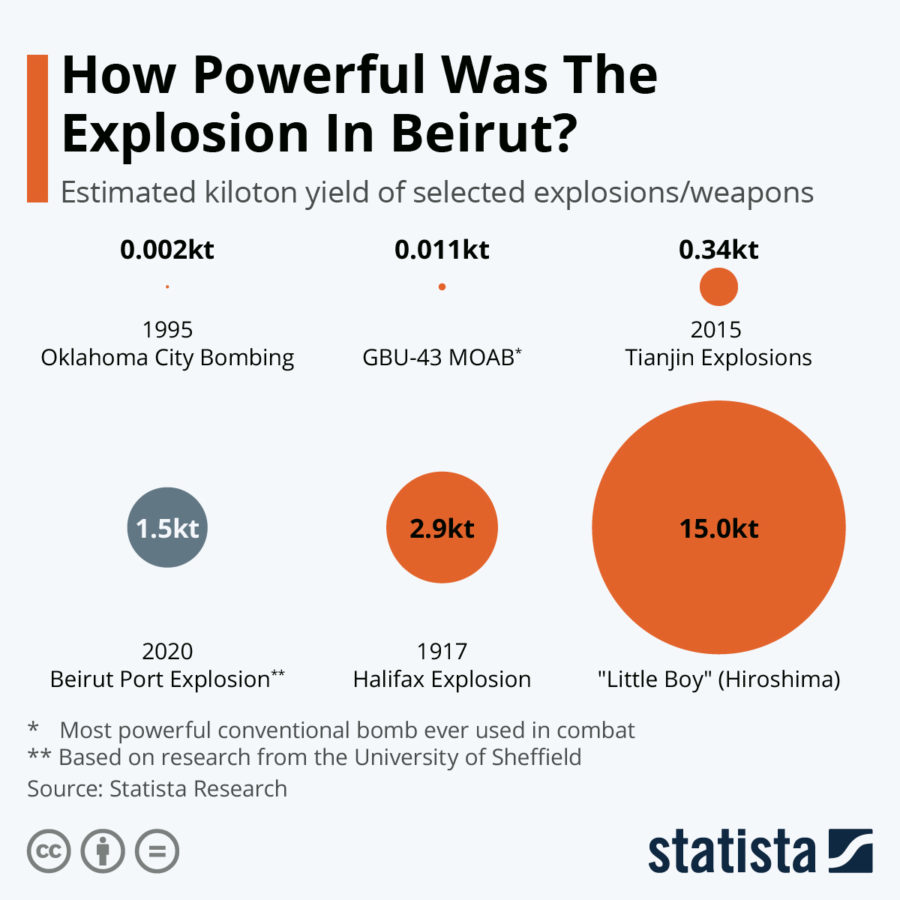

Furthermore, the Beirut Port blast in August 2020 had implications on a national level and contributed to Lebanon’s abiding structural vulnerabilities. These include poor infrastructure, malfunctioned power sector, inadequate management of solid waste and wastewater, water scarcity, poor financial management, macroeconomic imbalances, and declining social indices.

The blast claimed the lives of at least 200 people, destroyed thousands of houses and buildings, and caused billions of dollars in property damage. Lebanon averted a major COVID-19 outbreak initially. When cases peaked in January 2021, medical facilities and ICU beds were considerably strained. Thousands of Lebanese protested the political elite which they view as corrupt and ineffective.

Current Condition

The current economic crisis might become catastrophic in Lebanon, as burgeoning poverty living under the US$5.50 international poverty line, is expected to increase by as much as 28 percentage points by the end of 2021. The grievous impact of COVID-19 increased Lebanon’s unemployment rate from 6.04 per cent to 6.6 per cent in a year, the highest figure in a decade.

The failure of Lebanon’s banking and economic systems resulted in millions unable to afford basic necessities driven by diminishing foreign exchange assets and the elevating cost of foreign exchange subsidies such as food, medication, and fuel. Due to insufficient supplies of fuel, Lebanon underwent huge power outages.

Petrol stations are open for limited hours with long queues of drivers only to become frustrated and argue or resort to violence. Recently, Lebanon’s two main power plants have been shut down, effectively shutting off all state electricity in the country. Not only this but medication is in limited supply, and health-care services have been severely impacted.

In August 2021, the Lebanese government hiked petrol prices by 66 percent in a partial reduction of fuel subsidies to tackle fuel shortages. The government hiked prices yet again in September, this time by almost 38 percent. On top of that, major fuel is smuggled to Syria or hoarded and then marketed at high rates on the black market by profiteers.

A fuel-tank explosion in the town of al-Tleil in the Akkar region of northern Lebanon occurred in August, killing 28 and injuring at least 79 civilians. Infuriated citizens began blaming the authorities for their carelessness and corruption which prompted citizens to store fuel and in turn led to its depletion from the market.

Conclusion

The current situation in Lebanon is indicative of wider regional tendencies and difficulties. Poor governance, insufficient services, widespread corruption, and a conspicuous lack of accountability are the norm in the region. COVID-19 epidemic has only worsened these problems, and it has the potential to destabilize the region much further.

Along with physical reconstruction, Lebanon must emphasize the advancement of better institutions, effective administration, and a better business setting. Given Lebanon’s insolvency, foreign assistance and private investment will be critical to recovery. The amount and velocity with which investments and aid are mustered will be determined by the authorities’ ability to implement critical fiscal, budgetary, social, and governance changes quickly.

2022 elections and the hoped-for resolution of regional issues might induce new leadership to emerge, placing the country on the path to prosperity it so well deserves.

If you want to submit your articles and/or research papers, please check the Submissions page.

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.