Tashfeen Khan is currently pursuing his A levels and has a keen interest in politics and economics.

Pakistan has gone through its fair share of administrative reforms and has even experimented with different types of governance systems such as parliamentary, presidential, and semi-presidential throughout its history. Besides this, Pakistan has extensive experience of relying on foreign funds to run the state, but is that quick fix still available? The experts don’t like to think so, since USAID will not arrive anymore and the International Monetary Fund (IMF) loans come with heavy consequences. The people and even the political parties as well have seen what borrowed growth means for a country; interest payments can choke the economy. It is time to look inward and fix the problems we’re facing instead of looking for a savior because there isn’t one this time. Even the current PTI-led government promised to reform the tax system of Pakistan, so, do all roads lead to greater earnings from taxes?

The History

Pakistan has been an oligarchic state since its inception in 1947. The Muslim League relied on the landowning feudal elite to gather support from the masses as they did not have a proper political framework available, unlike its counterpart, the Congress. The landowners soon rose to become the political elite that would rule the country in the future.

Even under military rule, the landowning elite were an essential support to have as they would influence the support of the masses in their localities, thus leading to the practice of clientelism. The elusive status of these large-scale landowners’ families, which would form dynasties, meant the government couldn’t afford to tax them or their properties as perhaps a “normal” government would have. Hence, the revenue generated from taxes saw little escalation and the tax-to-GDP ratio of Pakistan was stagnant.

Be that as it may, at the time, this inconsistency between the revenue generated and the expenditure was not considered to be as immense a headache as it has become now. Perhaps, the hindsight was there, but the governments cared more about re-election than the long-term development of the revenue-generating mechanism.

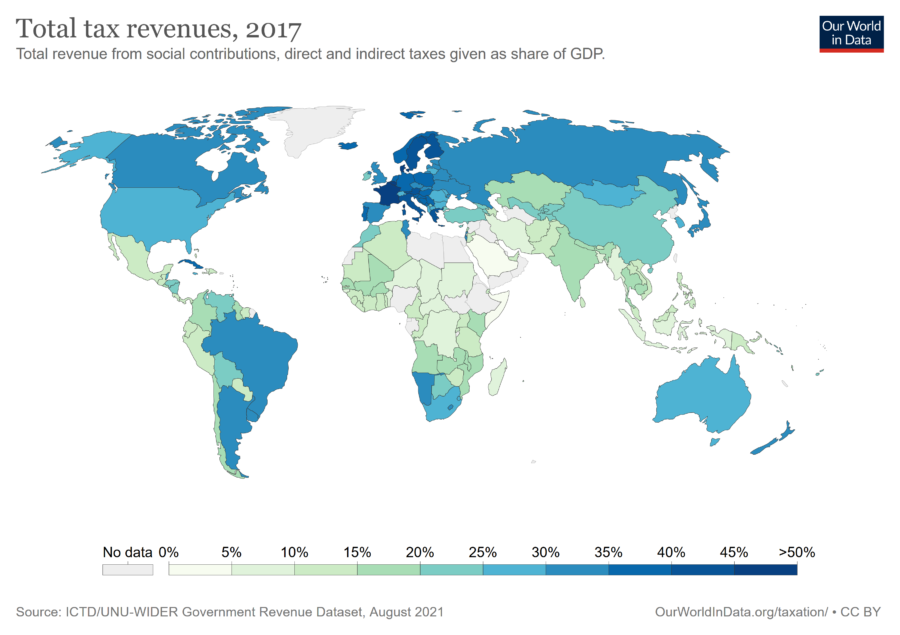

The history of borrowed growth in Pakistan, whether in the form of USAID or IMF loans, has meant that the governments didn’t focus on improving the tax system in the country. Capital could have and should have been spent on modernizing the tax system of Pakistan to improve tax collection, along with a focus on increasing the number of income tax filers and introducing taxes on sectors that generate the most revenue. Regrettably, however, this was not the case. In 2017, the tax revenues only contributed to 11% of Pakistan’s GDP.

A Proposal Rejected

As the Musharraf administration came into power, it took steps to try and transform the tax collections and administration of the country. The result was the “Tax Administration Reforms Program” or TARP for short. However, as the military regime was forced to find political allies in the 2002 elections, their charge for reforms died down.

The 2001 report by the Federal Board of Revenue (FBR) puts it bluntly on page 2 of chapter 1. It states, “If the taxes relative to the GDP do not increase significantly, without new levies, Pakistan cannot be governed effectively, essential public services cannot be delivered, and high inflation cannot be avoided. The reform of the tax administration is the single most important economic task for the government.”

What resulted was an even lower tax-to-GDP ratio of Pakistan in the Musharraf era of the 2000s than in the previous governments of the 1990s.

Direct vs Indirect Taxes

Tax collection has increased by 18.4 percent in the current fiscal year as compared to the last, according to the FBR revenue yearbook, and the board exceeded its target as well. These facts were greatly celebrated across the country, however, when you add the proper context to this, the situation looks different.

At a closer look, you will see that the most increase was in sales tax and customs duty while direct taxes increased by a meager 13.3%. This means that indirect taxes—sales, excise, customs—have been increasing more rapidly which entails that the taxes that are the same for the poor and the rich have been seeing more growth than the direct income taxes that are determined by how much they earn.

The original nor the revised target was reached for direct taxes. The implication of this is that imported and local food and grocery items have surged in prices while the income taxpayers are stagnant in growth. The essential reason taxes even exist is to redistribute wealth from the rich to the poor in the forms of services such as free healthcare, education and imperatively, to make sure they can afford to buy food. It’s a shame that the poor and rich both have to face the same high sales taxes while the number of income taxpayers remains as low as less than 2% of the population.

Why Don’t People Pay Taxes?

The answer is simple, the process of paying taxes is too complex and non-compliance is too easy. There are multiple taxing agencies and complicated tax rates, and the cost of compliance to them is high as well. Each province has its own taxing agency along with the FBR, and the excise and taxation department continues to function independently.

The same person may have to file 5 different tax reports and the process for each is tortuous. It isn’t too troublesome to disguise your actual true income or to just remain in the informal economy, away from any obligations to pay taxes.

The provincial revenue authorities also require the FBR officers to be posted in their departments as they usually lack the tax collection expertise and necessary labor force with the correct set of skills to function. This represents how ill-equipped Pakistan’s authorities are, whether it be in the tax collecting business or in providing a seamless way for paying taxes.

Steps Required to Reform the Tax System of Pakistan

There have been some steps such as the move to try to harmonize the sales tax in different provinces but frankly, more is required. The first order of business should be to singularize the provincial and federal tax collecting authorities as well as modernize their systems and educate the staff through proper academies. It will be difficult to get all the different provincial authorities on board but it is critical for fulfilling this herculean task.

The target should also be to broaden the tax net, not tax more on those that are already paying. To do this, different sectors that have been kept out of the taxpaying brackets need to be integrated into it. The agriculture sector, for example, contributes about 24% to the GDP however, only adds up to less than 2% in taxes. The housing industry is a similar woeful case; according to the Pakistan Economic Survey, it accounts for 7% of the GDP while only generating 0.3% in taxes.

These numbers represent a deep issue with the tax system in Pakistan. If these sectors are formalized and integrated into the taxpaying brackets, Pakistan can comfortably increase direct tax collections by a large margin. Experts also believe that the earnings from custom duty taxes in Pakistan can be increased comfortably.

Other than these two cases, there are also numerous businesses still operating in the informal economy. As it is said that Pakistan’s informal economy—accounting for 71% of the employment outside the agriculture sector—is as large as the formal economy, so it represents a large pool of potential taxpayers currently not contributing anything.

Pakistan’s Tax-to-GDP Ratio and Supporting More Taxes

The tax-to-GDP ratio of Pakistan in FY2020 was 9.6% which is extremely low for a country in this stage of its development. According to the economic survey, it was projected to increase to 10.9% in FY2021, which would translate to 4,963 billion PKR. However, the FBR could only manage 4,734 billion PKR which isn’t the end of the world either.

Finance Minister Shaukat Tarin asked the FBR to follow a target of taking the tax-to-GDP ratio of Pakistan to 20 percent over the next six to eight years. That is a little too ambitious per se, but after doing the calculations for a more conservative potential of 15% tax-to-GDP ratio by 2029, adjusted for a GDP growth rate of 4% per annum, it was found that the total tax collected would be 9354.2 billion PKR, an extra 4,620 billion PKR.

With that extra capital, every year the Government of Pakistan can pay off its debts in just a few years or it can triple its current defense budget, multiply the current health and education expenditure by five times, double the capital spent on power and petroleum sectors, and still have approximately 58.5 billion rupees left over to spend on infrastructure development, dams, canals, and poverty alleviation, etc.

Taxation has been Pakistan’s Achilles heel ever since its inception, but it is also the state’s only hope. It does not matter if you support more F17s for the air force, more hospitals for the poor, better education institutes, no load shedding, more pension, better transport infrastructure, a better irrigation system, or just less reliance on foreign aid, what you need to do is encourage yourself and everyone who isn’t a taxpayer to become one. The only reason you can give for not being a taxpayer is if you think the current state of affairs in this country is too good. A better future is a future we have to pay for.

If you want to submit your articles and/or research papers, please check the Submissions page.

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.