What is Carbon Taxation?

The idea of carbon taxation found its emergence in the late 1960s, when Arthur Little, Martin Weitzman, and Alfred Kahn recognized the potential economic impact of pricing carbon emissions to incentivize renewable energy consumption and improve energy efficiency. At first, the Canadian province of British Columbia introduced a carbon tax of $5 per ton of carbon equivalent emissions in 1989, but the idea spread across the globe.

In recent times, owing to the severe shifts in worldwide weather patterns, from witnessing unprecedented heavy rainfall in the deserted Middle East to the record temperature hikes in Europe and Britain, the subject of climate change has sought foremost attention from diverse perspectives. Carbon taxation is seen as one of the potential ways to forestall climate change by restricting environmentally unfriendly activities.

The emission trading system (ETS) is one of the largest pricing initiatives of carbon in Europe, regulating nearly half of the region’s greenhouse emissions; it includes 11,000 power stations. Similarly, China has launched its own national emission trading system and Canada has its own federal carbon pricing mechanism. The idea is also being incorporated by the renowned states of the USA in their policy agendas. For instance, the California Cap and Trade Program is a comprehensive program, setting caps on the emissions caused by power generation. So, around 45 countries had implemented some form of carbon taxation by 2024.

Issues in Implementing Carbon Taxation

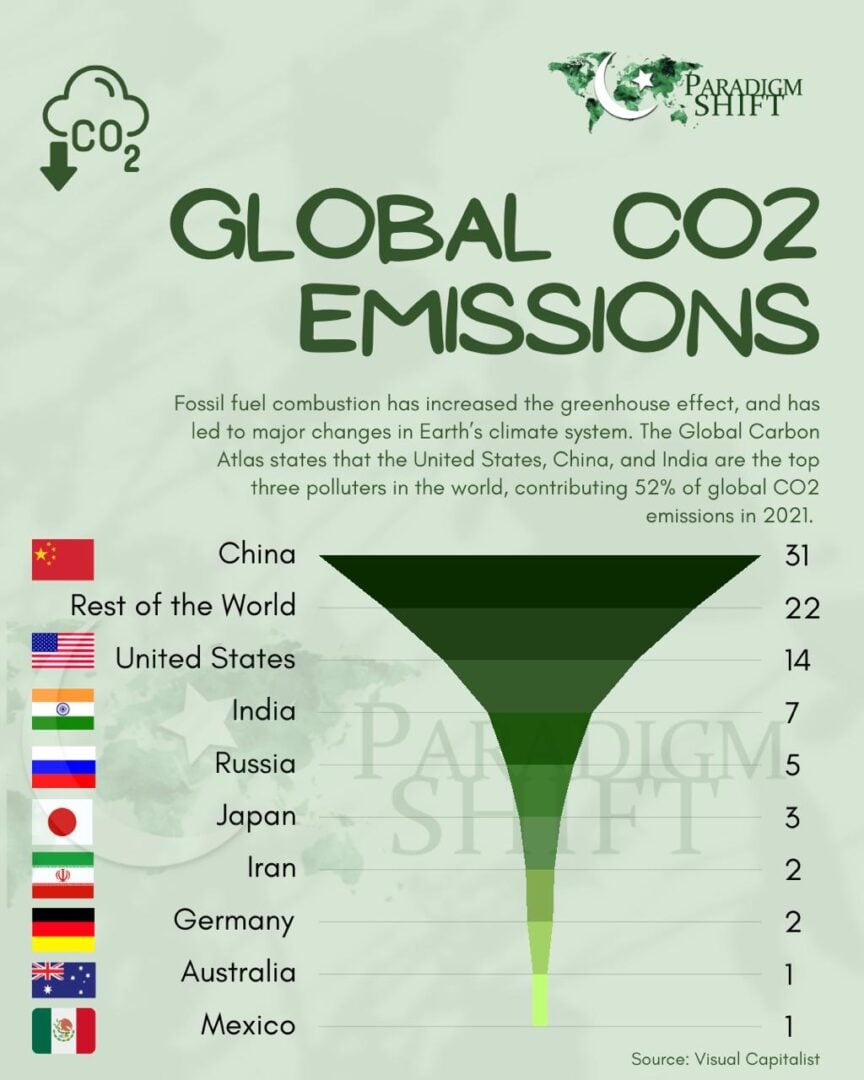

It seems like icing on the cake to tax the manufacturing industries, production plants, and processing units to discourage the use of carbon-emitting energy resources as an environmental protection measure. Although the strategy of carbon taxation has regulated carbon emissions in a particular European region, it has not served its holistic purpose efficiently. Global greenhouse emissions are increasing every year, even after the introduction of carbon pricing. This is mainly because the idea of carbon pricing overshadows the following aspects.

The carbon tax is usually passed on to consumers by the manufacturers in the form of price increments for the respective goods and services. This leads to consumption injustice by restricting the demand for particular goods for the middle and low-income classes, whose consumption is more income-sensitive than that of the elite class.

On the other hand, the skyrocketing fixed and maintenance costs of renewable energy sources are not affordable for many small and medium-scale manufacturing units. This cost would also be accumulated in the prices of final goods, making them barely accessible for a significant proportion of consumers, reducing the size of the consumer market.

Therefore, pertaining to the limited transformative capacity, it appears more convenient for the producers to stick to the utilization of non-renewable energy resources and capture the low and middle-income consumers by shifting the cost increments caused by the carbon taxation in the form of final prices. In both scenarios, middle and low-income consumers are at the receiving end in the form of inflation and consumption deprivation.

Besides the behavioral impact on consumption, there are some technical limitations associated with taxing carbon-emitting vehicles and industries. For instance, there have been concerns by environmental experts about defining the criteria for carbon taxation. Is it a correct approach to tax carbon merely on the basis of per-ton carbon emissions, regardless of its potential impact on different forms of emissions?

The emitted carbon possesses different forms, including carbon dioxide, methane, and other fluorinated gases, depending upon the type of fuel and method of combustion. The impact intensity of these multiple forms of carbon varies in polluting the environment. So, before implementing the carbon tax, it poses a logical constraint for the governments to categorize and monitor the industries and transportation services on the basis of the form of fuel and the combustion process being utilized. However, it becomes challenging for governments to adopt such an in-depth approach, considering the associated expenditures.

Recommendations

Contrary to implementing the carbon tax, governments should subsidize renewable energy to make it equivalent to or cheaper than non-renewable sources. Then, it can incentivize producers to shift to renewable means of energy without creating cost-push inflation for consumers. In this way, a possible reduction in the consumption of essential goods can be avoided to ensure social welfare.

Besides this, worldwide governments should introduce environmental credit shields for promoting the utilization of clean energy and categorize them according to business scales in a way that higher-scale businesses will get more government facilities. In this context, carbon credits refer to the level of government benefits that the users and suppliers can receive by switching to environmentally friendly energy consumption.

The importer can avail of the carbon credit gains in the form of low and free tariffs while importing machinery and transportation vehicles that do not release carbon in the air. The exporter can also gain an advantage in a similar manner. Therefore, it will also push the producer to make their production decisions by keeping in view the competitiveness of the global market.

Moreover, the governments should not only link the availing of environment credit shields with minimum to free tariffs on the imports of renewable energy machines but also with the ease of providing letters of credit to businesses for ensuring smooth trade in any circumstances. It will also incentivize businesspersons to document the true size of their businesses to avail themselves of maximum government facilities, which will ultimately result in broadening the tax base in undocumented developing economies.

Conclusively, governments worldwide should analyze if the carbon tax is an environmental tax to protect the environment or a mere fiscal tax to finance official expenditures at the cost of affecting the living standards of the middle and low-income classes. They need to adopt the measures mentioned above to safeguard the environment by considering as alternative ways besides taxing carbon emissions.

If you want to submit your articles and/or research papers, please check the Submissions page.

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.

Mr Muhammad Danish Raza is a final-year student of economics at the National Defence University, Islamabad.