Ms Aliza Nasir is currently pursuing a degree in International Relations from Kinnaird College for Women University.

IMF Agreement Overview

The IMF announced a staff-level agreement with Pakistan’s caretaker government, paving the way for the release of $700 million from the $3 billion bailout package. This marks the second tranche, following the initial disbursement of $1.2 billion in July 2023.

The IMF-Pakistan deal underscores the importance of Pakistan adhering to economic reforms outlined by the IMF, including revising the budget and phasing out subsidies.

Conditions Set by IMF

The conditions set by the IMF for Pakistan, associated with the disbursement of the second tranche of the $3 billion bailout package, are centered around economic reforms and stabilization measures. Key conditions typically include:

- Budget Revisions: Pakistan is required to implement revisions to its national budget. This includes adjustments to fiscal policies, expenditure allocations, and revenue-generation measures.

- Subsidy Phasing-Out: The IMF urges Pakistan to reduce or eliminate subsidies, particularly in sectors like electricity and fuel. This aims to streamline government spending and enhance the efficiency of resource allocation.

- Exchange Rate Policy: IMF programs necessitate a shift to a market-determined exchange rate. Allowing market forces to play a larger role in determining the value of the national currency can contribute to a more stable economic environment.

- Monetary Policy Tightening: To combat inflation and anchor expectations, the IMF recommends and requires a suitably tight monetary policy. This involves adjusting interest rates and other monetary tools to manage inflationary pressures.

- Structural Reforms: Beyond immediate economic measures, the IMF emphasizes structural reforms. This includes improving governance in state-owned entities, enhancing the viability of the energy sector, and strengthening the banking sector.

- Foreign Exchange Market Stability: Measures to ensure a well-functioning foreign exchange market are an integral part of the conditions. This is crucial for addressing balance of payments pressures and eliminating foreign exchange shortages.

- Climate Resilience: With an increasing global focus on climate-related challenges, the IMF encourages and requires measures to enhance resilience to climate-related risks. This involves policies aimed at mitigating environmental impacts on the economy.

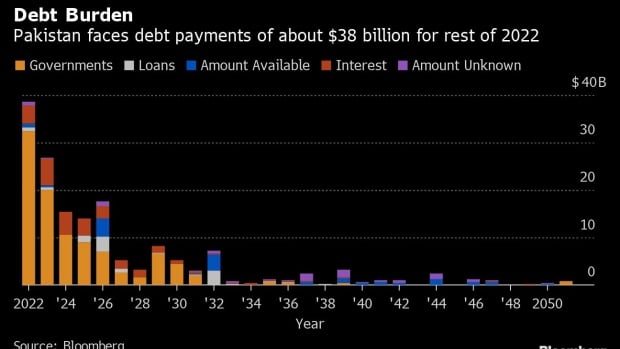

- Debt Management: Given Pakistan’s substantial external debt, effective debt management is an essential condition. This involves strategies to manage and reduce the overall debt burden, ensuring sustainable long-term fiscal policies.

Economic Situation and Challenges

Pakistan has grappled with financial and political instability for years, with its central bank’s foreign reserves dropping to less than $4 billion. The country faces a daunting external debt of over $20 billion in the current fiscal year. The Pakistani rupee has depreciated significantly, losing more than 50 percent of its value against the dollar in a year.

Source: BNN Bloomerg

Pakistan’s economic challenges encompass a delicate balance between addressing immediate financial crises, implementing necessary reforms, and navigating external risks. The success of the IMF program and the country’s economic stability hinge on sustained commitment to these measures amid a complex and dynamic economic environment.

The IMF’s Perspective

The IMF’s recent review acknowledges a nascent economic recovery in Pakistan, attributed to international support and improved confidence. However, the global lender cautions that the country remains susceptible to external risks such as geopolitical tensions and commodity price fluctuations. Efforts to build economic resilience are deemed crucial for sustained stability.

Policy Decisions and Macroeconomic Fundamentals

Despite challenges, analysts highlight the Pakistani government’s prudent policy decisions. These decisions include significant increases in energy prices and allowing the market to determine the value of the rupee. Such measures, in line with IMF requirements, have contributed to improvements in macroeconomic fundamentals.

Future Outlook and Political Stability

With national elections scheduled for February, the announcement of the vote adds a layer of stability to the political situation. Analysts suggest that the caretaker government’s implementation of tough economic measures and essential reforms aligns with IMF conditions. The prospect of an elected government negotiating another package with the IMF hinges on continued adherence to economic conditions.

Conclusion

Pakistan’s progress toward securing the IMF’s second tranche reflects a delicate balance between implementing necessary economic reforms and addressing external challenges. The IMF’s recognition of a nascent recovery underscores the importance of ongoing efforts to strengthen the economy. As Pakistan navigates its economic path, sustained commitment to reforms will be crucial for long-term stability and resilience against external risks.

If you want to submit your articles, research papers, and book reviews, please check the Submissions page.

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.