Introduction

Rare earth elements (REEs) are also known as rare earth minerals. They are a group of 17 chemically similar metallic elements, comprising the 15 lanthanides (from lanthanum to lutetium), as well as scandium and yttrium. These elements are not rare in abundance, but are rarely found in economically exploitable concentrations.

“The rare earth thing has been stunning in the message that it’s sent about how dependent Western economies, the United States, are not only on the automobile industry, for instance, but also the military on rare earth. That’s an advantage for China. That’s a high card that China has.”

Daniel Yergin in an interview on energy transition and geopolitics

It means that China controls not only production but also processing. Thus, China has a high card in great power rivalry. As nations rapidly transition to cleaner energy systems, the demand for rare earth elements (REEs) is surging, especially those indispensable to electric mobility, renewable energy turbines, and high-efficiency electronics. According to the International Energy Agency’s Global Critical Minerals Outlook 2024, rare earth demand for permanent magnets surged over 8% in 2023 and is anticipated to triple by 2030 amid global net-zero commitments. This trend is reconfiguring global power dynamics.

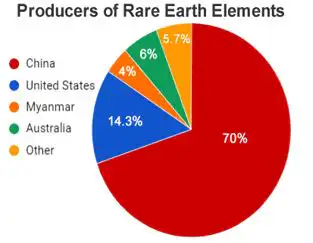

Despite their high-stakes positioning, REEs are not evenly distributed across the globe. The US Geological Survey’s Mineral Commodity Summary 2024 reveals that China dominates the REE sector, producing around 70% of the world’s supply and over 85% of processing operations under its control. China holds a de facto monopoly across the entire rare earth value chain. This imbalance has led Western nations, especially the US, EU, and Japan, to label rare earth elements s as high-risk exposures within their clean energy transition strategies.

China’s Monopoly and Strategic Leverage

China’s strategic leverage became evident in 2010, when it unofficially suspended exports to Japan during a diplomatic standoff over the Senkaku Islands. It sparked turmoil in global markets, highlighting the potential of REEs as levers of coercion in international disputes. Following the 2010 dispute, China has pursued a deliberate strategy to solidify its dominance and scale its influence in the global rare earth market. China has expanded its footprint in Myanmar, and it has invested heavily in Africa and Latin America.

Analysts warn that unless alternative supply chains are developed, China will dominate as a strategic lever in geopolitical rivalries.

Western Response: Late Awakening

As per the USGS, America is dependent on China for rare earth minerals, which is a national security risk. President Biden signed Executive Order 14017 (2021), which triggered a 100-day review of the US critical mineral supply chain.

Domestically, some companies are investors in the US rare earth Mineral project. MP Materials has claimed that the Pentagon would be its largest shareholder, and it is making a direct investment deal of $400mn million. According to Neha Mukherjee, rare earths research manager for Benchmark Mineral Intelligence, “This is the kind of long-term commitment needed to reshape global rare earth supply chains”

The US is reducing its reliance on China by strategic partnerships like the US-Australia Critical Mineral Agreement and the QUAD coalition. Malaysia’s Batu Hijau Mine and Lyna’s Brown Range Project in Australia are crucial for diversifying global rare earth supply chains beyond China.

Africa and the New Resource Scramble

Africa is swiftly becoming a key battleground in the global competition for rare earth minerals. The Democratic Republic of Congo is central to the colton and cobalt supply. The Gakara mine in Burundi, formerly regarded as the highest-grade rare earth project globally, was brought to a standstill in 2021 due to disagreements between the Burundian authorities and the British company Rainbow Rare Earths.

Tanzania has REE reserves near the Victoria Lake, which is seeking attention from Chinese and Western investors. However, the race for access has raised concerns about a renewed phase of neo-colonial-style resource extraction and major environmental damage from deforestation to contamination of water supplies.

Unless fair and open mining policies are enforced by both African leaders and global partners, the continent is likely to experience a renewed era of exploitation—disguised beneath a new geopolitical narrative.

Environmental and Ethical Dilemma

While rare earth elements are central to the green energy transition, they come at a steep environmental and ethical cost. Baotou in China – the major hub of producing rare earth minerals – suffers from toxic waste build-up and radioactive pollution and releases radioactive thorium and fluorine into the environment, contaminating water and soil, endangering farmland and posing major health risks.

Similarly, in the Democratic Republic of Congo (DRC), the extraction of rare metals like cobalt is found along with the mining of rare earth minerals, it is often linked with illegal mining, child labour and hazardous working conditions, due to this pollution rate is rising in that region which is extremely harmful for children working their forcefully.

This highlights a bitter irony that, indeed, rare earth elements are the main pillar of renewable advancements, but the process of procuring them is defaced by environmental degradation and serious ethical concerns, causing harm to life on earth and those who inhabit it. Without efficient management, the minerals needed for environmental protection could end up harming the environment.

Future Outlook: Decoupling or Dependency?

Demand for rare earth elements is increasing worldwide, leaving the question of whether the West can reduce its reliance or not. Complete decoupling might not occur immediately, but efforts are underway. Nations like Japan and the US are making efforts in this scenario by developing REE recycling mechanisms to recover materials from e-waste and magnets. It is not new; we should keep in mind that every advancement has its own flaws, but creativity lies in how nations deal with those flaws and harms.

Japan and the US are researching for substitutes like iron-nitride and graphene. This could eventually reduce reliance on rare earth elements, but it would be costly for China, as rare earth minerals are a plus point for China to attain hegemony in the region.

Space mining is also viewed as a visionary solution. Luxembourg’s pioneering space law and NASA’s Artemis Accords are initiating the framework for a cosmic mining project that could harness unexploited resources of rare earth elements. Until a feasible option emerges, supply chains remain susceptible to economic pressure and techno-nationalist strategies used for geopolitical advantage.

Conclusion

There is a global shift in competing for oil and gas to rare earth elements (REEs), which have emerged as a cornerstone of modern geopolitics, igniting strategic rivalries across the globe. A greener future must not come at the cost of people or the planet. The future generation has the right to live on a healthy planet. Ethical sourcing, innovation, and global cooperation are essential to avoid repeating past injustices. Real change needs responsible leadership.

If you want to submit your articles and/or research papers, please visit the Submissions page.

To stay updated with the latest jobs, CSS news, internships, scholarships, and current affairs articles, join our Community Forum!

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.

Syeda Farani Fatima is an undergraduate student of International Relations at the International Islamic University of Islamabad, with a strong interest in anti-corruption, counter-terrorism and geopolitics. Strongly committed to fighting corruption, terrorism, and supporting national reform through research and public service.