Ms Ayesha Zafar is currently pursuing her Bachelor's in International Relations from National Defence University, Islamabad. She has authored multiple academic publications including research articles and book chapters. Her areas of interest include Middle Eastern politics, the geopolitics of Central Asia, and the Indo-Pacific region

Evolution and Significance

The internet has revolutionized the world like never before. All aspects of our lives, from our existence to our interactions with others are under the influence of internet technology. In this regard, the 21st-century emergence of blockchain technology is a major breakthrough as it has brought massive transformation to the world of finance, especially with the advent of the digital economy—and now it is pivoting to the real estate sector.

Although the origin of blockchain dates back to 1991 when two researchers, Stuart Haber and W. Scott Stornetta, used it to protect their digital files from tampering, it was only in 2009 with the invention of bitcoin that blockchain found its real-world application. A paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” published by Satoshi Nakamoto in 2008 laid the grounds for the digital cash system.

Blockchain technology has a database shared among computer networks to maintain a secure and decentralized record of transactions. Unlike the traditional database, a blockchain stores data in several blocks of a certain storage capacity which are all interlinked and ordered chronologically. After a block gets filled with information, it is set in stone and becomes part of the chain.

All of this is decentralized which means that the blockchains are immutable and the data stored is irreversible. Due to the immutable ledgers and data encryption, blockchain is a type of distributed ledger technology. All blocks in the chain have a specific hash number which converts digital information into numbers and letters.

It eliminates the possibility of hacking since any attempt to alter the data in a block will automatically change the hash number of that block and would make the subsequent blocks invalid. Moreover, blockchain has a consensus mechanism known as proof-of-work which requires almost 10 minutes to add a new block to the blockchain, thus making it harder to alter the database.

Influence in the 21st century

The relevance of blockchain technology is increasing day by day. Today, a number of companies including Walmart, Pfizer, AIG, Siemens, and Unilever have incorporated blockchain technology to ensure secure and effective transactions using cryptocurrency that doesn’t require a third-party intervention.

For instance, in 2015, R3, a financial technology firm, initiated a program whereby around the top 100 banks including Citi, Bank of America, Deutsche Bank, National Australia Bank, Royal Bank of Canada, etcetera joined its consortium to establish a common crypto-technology-based platform.

As per the 2022 record, there are more than 10,000 active cryptocurrencies based on blockchain. A few of the most common cryptocurrencies include Bitcoin, Ethereum, Cardano, Stellar, Binance Coin, Ripple, and Litecoin. Today, a number of activities involve the use of blockchain technology, like healthcare, finance, supply chain, IoT, automobile, real estate, etcetera.

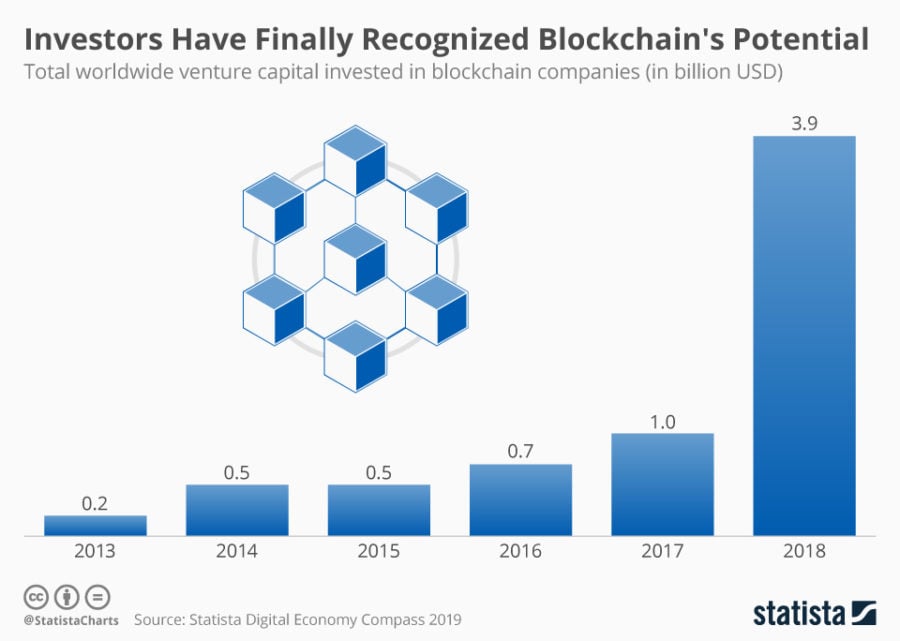

Hence, it has gained much attention in very little time as around 91% of the banks had invested in blockchain solutions by 2018. Likewise, 66% of the institutions are expected to be running at scale with blockchain. It was in 2011 when bitcoin for the first time gained parity with the USD, with one bitcoin being equivalent to one USD. However, in 2013 it reached 100 USD, by 2017 it was $1000/BTC and finally, it reached $30,000 by the end of 2020.

Two Variants of Blockchain

There are two key variants in blockchain, public and private. Public blockchains are the ones available for use to everyone with the records of transactions easily visible to those having internet access. In contrast to this, private blockchains are limited to a single organization with only a few authorized individuals having permission to verify and add transaction blocks.

Correspondingly, after purchasing cryptocurrency on exchanges, such as Coinbase and Bitfinex, it can either be stored in hot wallet storage that uses online software to protect assets or cold wallet storage that relies on offline electronic devices.

Pros and Cons of Blockchain Technology

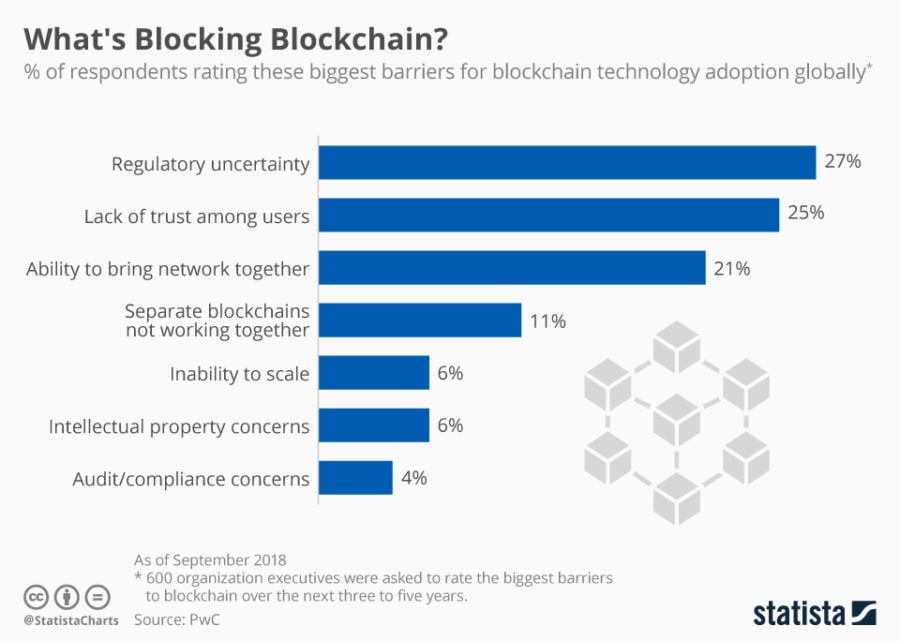

For every technology, there are certain pros and cons. Blockchain technology has a number of advantages, yet, at the same time, the disadvantages attached to the use of blockchain technology, new innovation with the least regulation and no central authority, cannot be ignored.

Pros

Blockchain technology provides accuracy, reduces cost, ensures transparency, and offers protection against fraud and mismanagement. For instance, to spread an error across the entire blockchain requires altering data in at least 51% of the network computers which is nearly impossible.

Moreover, the decentralization of information across various networks ensures protection against scams; even if the hacker were to get access to a single copy of the information, the rest would remain intact. Likewise, the blockchain works 24/7 and hence transaction is possible within minutes which not only increases efficiency but also makes it time-efficient.

According to a report by the World Bank, an estimated 1.7 billion adults do not have bank accounts or other means of storing money. Hence, for individuals like these, digital currency in the form of bitcoin provides an opportunity to keep their money safe and on record.

Not only this, all personal information is secured as the one who makes the transaction is provided with a unique code called the public key which is recorded on the blockchain and guarantees protection against fraud. Countries have also started using it to ensure protection against fraud in elections. Each citizen is issued a single cryptocurrency or token which they can send to a specific wallet address of whichever candidate they wish to vote for.

In the November 2018 midterm elections in West Virginia, blockchain technology was used to ensure greater transparency and increase voter turnout. Similarly, blockchain provides a bedrock for cryptocurrencies. Unlike the US dollar which is controlled by the Federal Reserve, blockchain allows cryptocurrencies like bitcoin to function without a central authority. This reduces the transaction cost and makes it time-efficient without the need for third-party regulation.

Cons

Blockchain technology has its own disadvantages. First and foremost is the use of blockchain technology for illicit activities on the dark web. The most commonly referred example in this regard is of an online dark-web illegal drug and money laundering marketplace called Silk Road which was operational since 2011 but was finally shut down by the FBI.

Unfortunately, anything that is online is prone to attack by hackers no matter how much encryption has been provided. In this regard, the biggest blockchain hacks include the Poly Network Hack in 2021 of $610 million and the 2018 Coincheck of $534 million.

Although a transaction is time-effective, it is limited to merely seven per second, and the storage capacity of blocks is limited. Many experts think that blockchains and cryptocurrencies are part of an investing bubble and only those who can afford may put some of their assets over the blockchain.

Apart from this, crypto-mining requires a considerable amount of energy as an MIT study showed that 10% of miners account for 90% of mining capacity. Around 0.21% of all of the world’s electricity goes to powering bitcoin farms which is equivalent to Switzerland’s yearly power consumption.

Moreover, the rapid surges and crashes in the digital economy that entirely depend on supply and demand with no government regulation are not favorable. For instance, bitcoin reached $17,738 in December 2017 before dropping to $7,575 in the following months. Only a few including the United States, Canada, Australia, El Salvador, and the United Kingdom have allowed its usage, while 42 countries including China, Bahrain, Libya, Kuwait, Cameroon, and Egypt have banned it completely.

Impact of Blockchain Technology on Real Estate

The real estate industry is changing dramatically, as new technologies like blockchain have brought a massive transformation in the way transactions occur. It has opened new windows of opportunity by providing real estate a platform to finalize deals using smart contracts that don’t require a third-party intervention and with payment being easily made using digital currency.

All land registry and ownership information are permanently stored in the blocks from where it can’t be altered. New deals can be finalized in just a few minutes over platforms like ATLANT. Earlier this year, the mayor of Miami, Francis X. Suarez, allowed the locals to pay property taxes with cryptocurrency, and the payment of a Miami penthouse sold for $28 billion was made with bitcoins.

Lately, the Sweden land registry has started using blockchain technology to keep a record of property transactions which could save over €100 million yearly by reducing the need for paperwork. Not just this, the impact of blockchain technology on the Commercial Real Estate (CRE) industry is worthwhile as it allows tenants, brokers, and buyers to easily access and share property listing information. The most active companies for these include Gaucho Group Holdings, Coinbase Global, and the AdvisorShares Sage Core Reserves.

Also, there are organizations like CryptoProperties (CPROP), Evareium, and Slice Market that have shown commitment to developing a real estate cryptocurrency. Hence, combining real estate, which is the biggest investment market with total assets valued at $280 trillion, and blockchain is the talk of the town.

Nevertheless, with benefits come disadvantages as well. If blockchain is opening new doors of opportunities for real estate, it at the same time brings multiple challenges as well. Firstly, it is the absence of any central authority to regulate and keep a check on the activities in the real estate market via blockchain. This not only increases the chances of fraud but also makes the currency fluctuate rapidly as cryptocurrency only relies on demand and supply.

As mentioned above, bitcoin reached $17,738 in December 2017 before dropping to $7,575 in the following months. Hence, without government intervention and the involvement of a third party like a bank, a transaction using blockchain technology opens the likelihood of it being attacked by hackers.

The Case of Pakistan

In 2021, Chainalysis Global Crypto Adoption Index ranked Pakistan number three among the top ten countries with the highest number of crypto users. Its crypto market capitalization crossed over $2 trillion during the Covid-19 pandemic, with the crypto value having seen an unusual hike of 711% and having recorded $20 billion during the 2020-21 fiscal year.

In Pakistan, given its promising potential, individuals and businesses are foraying into the real estate business, with Zameen, Graana, and Ilaan dominating the business. DAO PropTech, in particular, is a digital platform that connects suppliers and investors while ensuring transparency, affordability, and inclusivity in the real estate sector.

Nonetheless, in Pakistan, cryptocurrency is not legalized. Although the Khyber Pakhtunkhwa (KPK) Assembly unanimously passed the resolution to legalize cryptocurrency, the Security and Exchange Commission of Pakistan (SECP) has not granted any approval. Lately, the Federal Investigation Agency (FIA) has also issued a notice to Binance, a cryptocurrency exchange, as it was alleged that it was involved in a scam involving around $100 million.

Conclusion

Undoubtedly, blockchain technology has revolutionized the world, with the world investment in crypto, as of the 2021 data, having increased up to $30 billion which is more than all the years combined. According to PitchBook Data, in 2021, the total market cap of cryptocurrency reached $3 trillion which is most likely to triple by 2030.

Henceforth, despite the massive opportunities blockchain technology provides, its future and people’s perception of it will remain uncertain for years to come unless and until there is proper legislation to regulate digital currency.

If you want to submit your articles, research papers, and book reviews, please check the Submissions page.

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.