Ms Afifa Iqbal has a keen interest in identity politics, colonialism and post-colonial development. She is currently working as a Research Assistant at ITU while pursuing her postgraduate studies in Development, Technology and Policy. She is a Gold Medalist in Political Science from the University of Punjab.

Introduction

The politicization of the foreign exchange reserves, with both sides of the aisle attempting to skew data in their favour, is adding to the perplexity of the concept. Even more than that, these faux value judgments make it difficult to discern the historical trends and understand the policies that have a real-time impact on the foreign exchange reserves.

In other words, it has become difficult to separate the wheat from the chaff. To get out of this labyrinth of fabrications and deliberate confusion, the basics of the concept offer the best shot.

What Do We Mean by Foreign Exchange Reserves?

Foreign exchange reserves simply constitute the reserves of foreign currency held by a country’s central bank. Investopedia defines foreign exchange reserves as, “assets held on reserve by a central bank in foreign currencies. These reserves are used to back liabilities and influence monetary policy… Foreign exchange reserves can include banknotes, deposits, bonds, treasury bills and other government securities. These assets serve many purposes but are most significantly held to ensure that a central government agency has backup funds if their national currency rapidly devalues or becomes entirely insolvent.”

So, at its core, the foreign exchange reserves are the backup fund of a country which can be used to offset external and internal shock events. Foreign exchange reserves are also required to pay for the imports. These imports can range from consumer goods to raw materials for different industries.

For instance, if import-substituted industrialization is the goal, then, an array of cutting-edge technologies and machinery has to be imported which is paid for with the foreign exchange reserves. Keeping all other variables constant, this imported technology and machinery can help the country in expanding and/or diversifying its industrial base.

The industry produces goods which can be imported thereby adding to the foreign exchange reserves. On the other hand, if imports outstrip exports or constitute mainly consumer goods, then it has a negative impact on forex supply. Pakistan serves as an example in this regard.

Accumulation

The next step is to understand how foreign exchange reserves are accumulated. Exports are the main source of accumulation. As the balance states, “The country’s exporters deposit foreign currency into their local banks. They transfer the currency to the central bank. Exporters are paid by their trading partners in US dollars, euros, or other currencies. The exporters exchange them for the local currency. They use it to pay their workers and local suppliers.”

Within East Asian countries, there was a trend towards the excessive accumulation of foreign exchange reserves after the East Asian Crisis of 1997 in a bid to stabilize the domestic economy and offset the impacts of shock events in an inherently volatile world economy. Apart from East Asian countries, many strong economies of the world hold an impressive forex portfolio.

The 2017 data published by CIA World Factbook puts this tendency into perspective; Joshua Aizenman and Daniel Riera-Crichton argue in a paper published in 2007 that this over-accumulation creates a buffer against volatile terms of trade, especially for the developing countries.

They summarize their findings as, “Our paper suggests that hoarding and managing international reserves has the effect of mitigating the impact of TOT shocks on the REER [Real Effective Exchange Rate]. Consequently, countries exposed to TOT volatility may benefit from active management of international reserves in ways that go well beyond the conventional prerogative of a central bank…”

The Curious Case of Pakistan

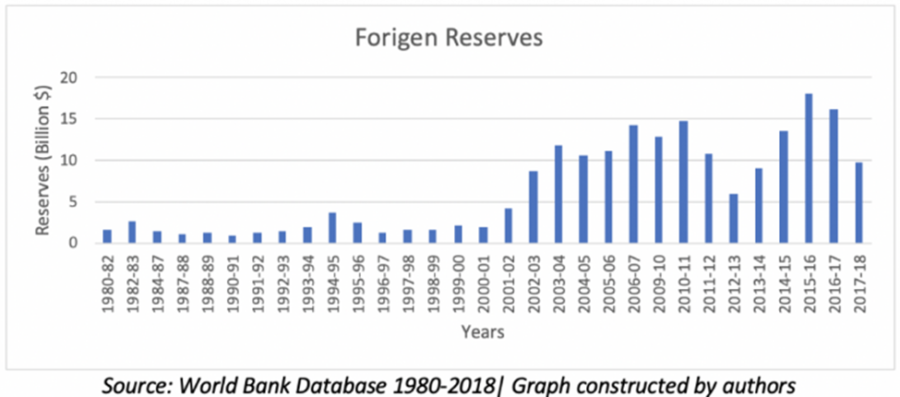

Pakistan began the excessive accumulation of foreign exchange reserves in 2001 and continued to do so till 2006-7 which had a positive impact on the overall economy. Many external factors, including the war on terror and foreign aid inflows, provided supportive conditions for this accumulation. However, since then, Pakistan forex holdings have followed a tumultuous path.

In fact, a lack of a coherent economic policy in the past resulted in an increase in forex holdings with favourable external events and vice versa. The following graph constructed by Christopher Finnigan with the help of World Bank data puts things into perspective; Pakistan forex holdings were constantly low before 2001-2.

Afterwards, they remained in flux owing to incoherent and obsolete domestic policy, external shocks and fragile alliances with the global powers. According to figures released by the State Bank of Pakistan, the forex holdings decreased from 17426.40 million USD in March 2022 to 16406 million USD in April 2022.

This recent downward trend has mainly been triggered by the trifecta of political uncertainty; an obsolete economic policy resulting in a negative trade balance, the outstanding balance of payments, debt crisis, unproductive investments; and a hostile external environment.

The Politicization of the Issue

The politicization of forex holdings, in the wake of Imran Khan’s ouster, is making it hard for the citizenry to make sense of the current situation. This politicization has often entailed either misquoting facts or partially reporting them. For instance, Startup Pakistan reported that Imran Khan was the only PM to have left 22 USD billion in the Federal Reserve.

As economic journalist Ariba Shahid pointed out in her tweets that not only were the reported figures from February 2022 instead of March 2022, the forex holdings (17426.40 million USD) did not entirely belong to the government.

Another economist, Ammar Khan pointed out that approximately 7 billion USD were private deposits, “From the remaining, a large chunk is ‘deposits’ from China, KSA, UAE, etc., which can’t technically be used. Unencumbered reserves are much lower. ” This whole exchange is just one example of how data is misreported for political expediency which adds to the political chaos thereby confusing the public.

Course Correction: Possibility or Illusion?

In an interview with Aljazeera, Pakistan’s Finance Minister Miftah Ismail stated that the government had a strategy to boost the foreign exchange reserves. The strategy in question included putting a blanket ban on various import items and later on, rolling back fuel subsidies. This, however, is a temporary fix at best which creates more problems than it solves.

The genuine course correction requires divesting from real estate development into a productive and export-oriented local industry that can provide a sustainable supply of forex reserves. Whether this can happen or not, depends on the political will and economic planning which is nowhere to be found nowadays.

If you want to submit your articles, research papers, and book reviews, please check the Submissions page.

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.