Sibra Waseem is a student at National Defense University, Islamabad. She is currently pursuing a bachelor's degree in strategic studies.

Not the Year That the US Was Hoping For

The year 2023 apparently is down on the United States of America’s luck. The ambitious Chinese Belt and Road Initiative, the increasing sway of China in the Middle East reinforced by its brokered deal between Iran and Saudi Arabia, the forging of ties between Russia, China, and Africa, the signing of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) without U.S. participation are a few cases in point.

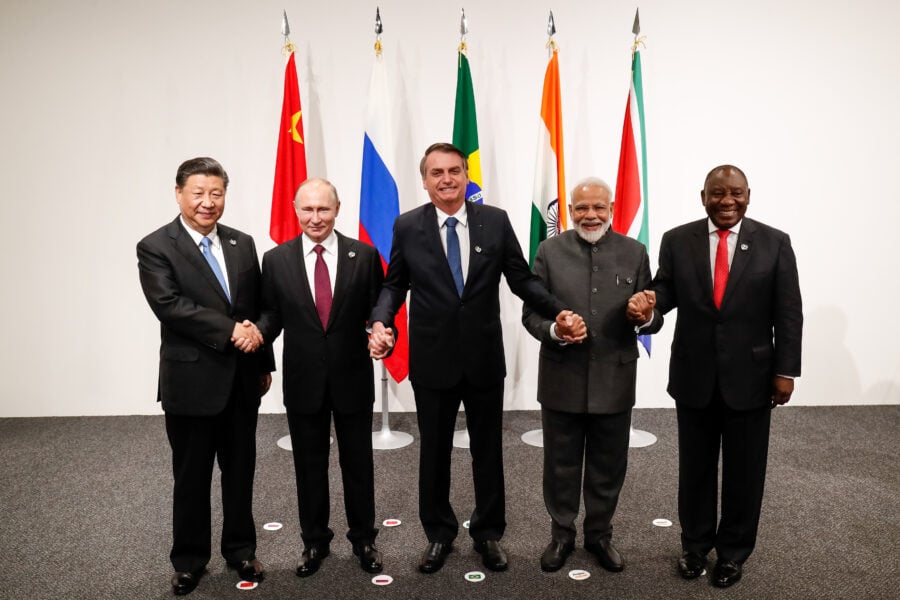

However, the major jolt came with a tweet from the official handle of the Russian Embassy in Kenya and state-owned Broadcast, RT, which stated the BRICS nations’ (the multilateral bloc of Brazil, Russia, India, China, and South Africa) initiative to introduce a new reserve currency, pegged by gold, rare earth metals and other critical commodities replacing the US dollar.

Consequently, this strategy is in the pipeline, and apart from the discussion of BRICS’ expansion is the central theme in the upcoming BRICS summit to be held from 22nd to 24th August 2023.

De-dollarization Continues

Naturally, one quizzes on what factors instilled the idea for the de-dollarization. The central banks in Europe and Asia had an unquenchable desire for US Treasury securities denominated in dollars. This, in turn, granted Washington the freedom to spend money and manage its debt without constraints. If any country deviated from political or military norms, Washington had the power to impose sanctions, isolating that country from the global trade system-weapons dollar.

Nevertheless, the BRICS currency seems likely to be the establishment of a new global monetary framework resulting in a significant rearrangement of political, economic, and military order. This would entail a restructuring of global geopolitical dynamics on a scale comparable to the changes witnessed after the conclusion of the Cold War or even World War II when the dollar was made the international standard currency.

BRICS Currency: Aye Or Nay?

Perhaps the BRICS currency is seen as an effort to enhance inclusivity and equity in global trade, as the dominance of the US dollar has led to global economic instability for specifically US disliked states. Moreover, the suspension of Russian assets by the US and the EU after the Russian invasion of Ukraine (the West froze Russia’s US$330 billion in reserves) has also boosted Moscow to instigate others to look into alternatives to utilizing the dollar as a reserve currency. Since then, SWIFT, the worldwide messaging system that permits financial transactions, has been unavailable to Russian banks.

Probably, Putin has accepted that the ruble isn’t going to replace the dollar anytime soon and his latest idea is to back the BRICS currency. At the same time, where many states, as per count, 40, which even include oil-based economies of Saudi Arabia and Iran that have expressed the desire (22 formally asked) for the membership have also shown their nod to the matter. It is pertinent to note that Russia, Iran, and Afghanistan (interested in joining) economies are sanctioned by Washington. As a result, they too are keen on posing a threat to dollar dominance.

Adversely affected by the US interest rate rise, monetary policy, and geopolitical tensions on global trade prices which are denominated in dollars, has fed the move. The damage to Uncle Sam can be analyzed by the fact that the BRICS nations contribute one-third of global economic production, and their total output surpasses that of the G7 nations.

To make matters worse for the US, in case the 40 nations join the group, it will prove to be a bolt out of the blue for America. Where approximately 88% of worldwide commerce is currently handled in US dollars and accounts for 58% of global foreign exchange reserves, only to be replaced by the BRICS currency would certainly be an economic dent.

If the goal is achieved, the rest of the world would likely have to lessen their foreign reserve holdings of US dollars and increase their holdings of the new BRICS currency. Probably states may find the BRICS currency more appealing because it’s not controlled by a single country, unlike the dollar. For centuries, the imperialist countries have used their military and financial supremacy to siphon off resources and lay labor out of the rest of the world.

Observing instances where the United States confiscated Russia’s reserves and Venezuela’s gold, and compelled the sale of Venezuela’s oil company CITGO, even nations allied with the US are hesitant to retain assets in dollars or on American soil due to concerns about potential seizures.

BRICS: A Formidable Challenger

The BRICS Interbank Cooperation Mechanism was established in 2010 to ease cross-border transfers in local currencies between BRICS banks. BRICS nations have been working on “BRICS pay,” a payment mechanism for BRICS transactions that eliminates the need to convert local currency into dollars. There have also been discussions of creating a BRICS cryptocurrency and strategically coordinating the development of Central Bank Digital Currencies to facilitate monetary interoperability and economic integration.

The BRICS nations have made headway in diminishing the dominance of the dollar in trade settlement. For instance, they have expanded their attempts to settle trade in other currencies, as seen by the rapid internationalization of the Yuan. Local currency settlement is seen as a significant advancement in this trend, with over 80% of China-Russia commerce currently settled in local currencies.

Moreover, Russia was the first nation to ratify a deal in April under the Contingent Reserves Arrangement to establish a $100 million foreign currency reserve pool. This effectively is a stockpile of foreign currency that any of the BRICS countries can draw into if necessary. The BRICS nations have signed agreements with the interested members to conduct trade and commerce in national currencies or another case Yuan.

Seven of the thirteen OPEC nations have sought to join the BRICS. As aforementioned, Iraq, Saudi Arabia, and the United Arab Emirates are all actively looking for dollar substitutes. In the 2023, World Economic Forum in Davos, Saudi Arabia’s Finance Minister Mohammed Al-Jadaan proclaimed that the Kingdom was receptive to engaging in trade in other currencies, apart from the US dollar. The measure is definitely unconventional in Saudi politics in the last 50 years, marking the termination of the petrodollar system of 1973.

Where Indian-Saudi has held rupee-riyal trade talks in this regard, India-U.A.E have agreed to switch to the Indian rupee and so have Brasilia and Beijing reached a deal for exchanging Yuan for Real. On account of dwindling US reserves, China-Argentina (using Yuan as a lifeline) and India-Bangladesh, Sri Lanka, Malaysia, And Egypt-India have eyed the de-dollarization motive. Even France, a US ally has not resisted conducting a Yuan settlement for LNG trade with China.

To add up to Western frustrations, China feasted on cheap, sanctioned Iranian and Venezuelan oil. Pakistan-Russian oil deal in Chinese yuan is another example. In addition, central banks have moved to diversify their currency reserves away from the dollar and towards amassing gold reserves. According to the IMF World Gold Council, Singapore (51.4 tonnes), Turkey (requested membership-45.5 tons), China (39.8 tons), Russia (31.1 tons), and India (2.8 tons) purchased the most gold in the first two months of this year. Apparently, this signifies that BRICS states are stockpiling gold in anticipation of their new currency.

Meanwhile, the IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) states that the central banks’ holdings of US dollars are dropping. Fitch Ratings has also downgraded the US debt rating from its highest AAA to AA+. Adding on, 2002 statistics, demonstrates that the US dollar has declined against the Russian Ruble and Brazilian Real this year, whereas the Euro has depreciated against all BRICS currencies. However, there is no denying that the proposition to counter the dollar faces substantial challenges and formidable obstacles.

The BRICS grouping emerged as an association of major emerging economies to enhance their influence in global economic and political matters, whereas the EU was formed with the primary goal of promoting economic integration and preventing further conflicts in Europe after the devastation of World War II. Questions such as what is common among the BRICS members apart from the fact that they were the emerging economies when the acronym was then derived by Jim O’Neill?

The issue is that BRICS is not a really helpful economic word. It combines a future economic giant in China with three essentially stagnant commodity exporters—all of which differ in terms of trade, growth, and investment. The conflicting priorities are the biggest roadblocks in acceding to a common Western-opposed currency. Considering the case of India and China, the two strategic rivals, India is an ally of the US and has signed multiple agreements with it to counter China in the South China Sea, and both tussle for power in Asia.

Indian External Affairs Minister Jaishankar lately steered clear by indicating rather to make his nation’s currency, the rupee robust, and a case of nationalism versus multinationalism. Moreover, India’s commitment can be interpreted from the authorization by India’s central bank, RBI, which has allowed 18 states to transact in rupee. China definitely will not sit back patiently, allowing Indian currency to go global.

Not only this, the statement was followed by appalling measures such as reducing Russian oil Imports and increasing US crude purchases. This illustrates that India is in no mood to incline toward Russia and China when it comes to Washington’s support and the statement from such a credible official is proof that the Republic has no desire in bolstering this BRICS objective.

Countering the criticism, advocates of the plan have pointed out that even though China-India relations alternate between détente and antagonism, both are keen to collaborate to some extent. For instance, India participates and invests in the BRI through the Asian Infrastructure Investment Bank, the New Development Bank, and the Shanghai Cooperation Organization. The future geopolitical and economic environment is reshaping, and the United States looks to be excluded from it.

In an attempt to de-dollarize, countries like Russia and China would have to liberalize capital flows but this seems unlikely. If Xi Jinping wants to inflict pain on Biden’s currency, he would have to liberalize his finances and make the Yuan a true competitor to the dollar. However, this requires him to move in the direction of markets, and that is in contrast with his current domestic goals.

Addressing the skepticism, they narrate the Shanghai International Energy Exchange (INE) of 2018 but it cannot be negated that it is to China’s advantage as contacts traded in INE are solely in the Chinese Renminbi. In 2001, when the research paper by Neill titled “Building Better Global Economic BRICs” was published, Russia was certainly an emerging market. However, it is contrasted by the recent stats which indicate a negative growth of around -2% to -4.5%, in 2022 and to follow suit.

Just as the issue of de-dollarization is disputed, similarly its expansion is wrangled. While China’s GDP increased from $6 trillion in 2010 to approximately $18 trillion in 2021, the economies of Brazil, South Africa, and Russia remained stagnant. India’s GDP grew from $1.7 trillion to $3.1 trillion but was outpaced by China’s growth. Common currencies only really work when countries have at least relatively similar economies and even small trading balances (explains the cases of so-called deficit countries in the Eurozone or Brazil’s plan to form a common currency with Argentina still hasn’t happened).

In contrast, the bloc is severely imbalanced and they are completely different economies. For example, take the case of India and South Africa both running consistent and large deficits with the other members which means they buy more than they sell with the other members and India is an infinitely more open economy than say Russia. As a matter of fact, some of the group’s most ambitious previous endeavors to establish significant BRICS projects to complement non-Western infrastructures have failed.

Ambitious proposals like establishing a BRICS credit rating agency and constructing a BRICS underwater cable never came to fruition. In a nutshell, with the BRICS’ economic power imbalances and complicated political dynamics, creating a unified currency would be challenging. For a new currency to function, the BRICS must agree on an exchange rate mechanism, as well as have efficient payment networks and a well-regulated, stable, and liquid financial sector.

Certainly, the BRICS initiative to establish an alternative reserve currency, while presenting substantial challenges, reflects growing discontent with the dollar-dominated global trade system. As geopolitical dynamics shift and economic imbalances persist, the prospect of a new monetary framework offers a transformative potential, challenging the established norms and redefining the future of global economics.

If you want to submit your articles, research papers, and book reviews, please check the Submissions page.

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.