Mr Muhammad Hamza Tanvir is an independent journalist and a political analyst, focusing primarily on regional and global strategic and political issues. He has authored numerous articles for different national and international publications.

Introduction

Whenever a rising power has challenged the status quo of a ruling power the result has been deadly bloodshed as proposed by Thucydides in his famous Thucydides’ Trap. China and the United States also seem to be ensnared in the same trap and are also heading towards the same war which neither side wants, as depicted by the statements of General Mark A. Milley, the Chairman of the American Joint Chiefs of Staff. The US and China are entangled in a trade war. China has been accused of currency manipulation and the devaluation of the yuan.

Instead of a conventional war, the two states are confronting each other on the economic front, a yuan vs dollar battle. The modes of confrontation have changed now due to the rise of nuclear technology and the resulting mutually assured destruction (MAD). President Barrack Obama, in 2011, showed his frustration against China’s currency maneuvering but he never branded the country as a currency manipulator directly.

However, President Trump, in August 2019, officially declared China a currency manipulator in one of his tweets and his treasury department also followed suit which made it the official stance of the then American government. This statement was given by President Trump after China’s currency devaluation in response to the US tariffs on Chinese products.

What is Currency Manipulation?

Economists usually refer to currency manipulation as when a country or state runs a large overall trade surplus and often buys dollars to keep its currency from rising in value. Weak currency gives its exporters an edge in the international market. Currency manipulation and devaluation are imminent in the early stages of a country’s economic development. China, for instance, kept its currency low from the mid-1980s to the late 1990s to keep its labor and production costs low. This assisted the country to attract foreign investment and accumulate foreign exchange reserves.

On the other hand, an overvalued peg makes the currency of a country stronger than its original value. The exports of such countries suffer due to being expensive. Thus, countries like Pakistan can never peg their currency to overvalue as it would exacerbate the already stagnant export industry of the country.

It is cogent that China manages its currency to control the price of its exports to the United States. The country did the same to counter President Trump’s tariffs on Chinese goods. But this is not something called currency manipulation if the aforementioned definition given by the economists is considered in its true spirit. The US Department of the Treasury also dropped its designation of China as a currency manipulator, in January 2020 in its semi-annual currency report.

Yuan vs Dollar

China impacts the dollar, directly, by pegging the value of the yuan loosely to the US dollar. An altered genre of the conventional fixed exchange rate is used by the central bank of China which varies from the floating exchange rate that most of the countries, including the United States of America, use.

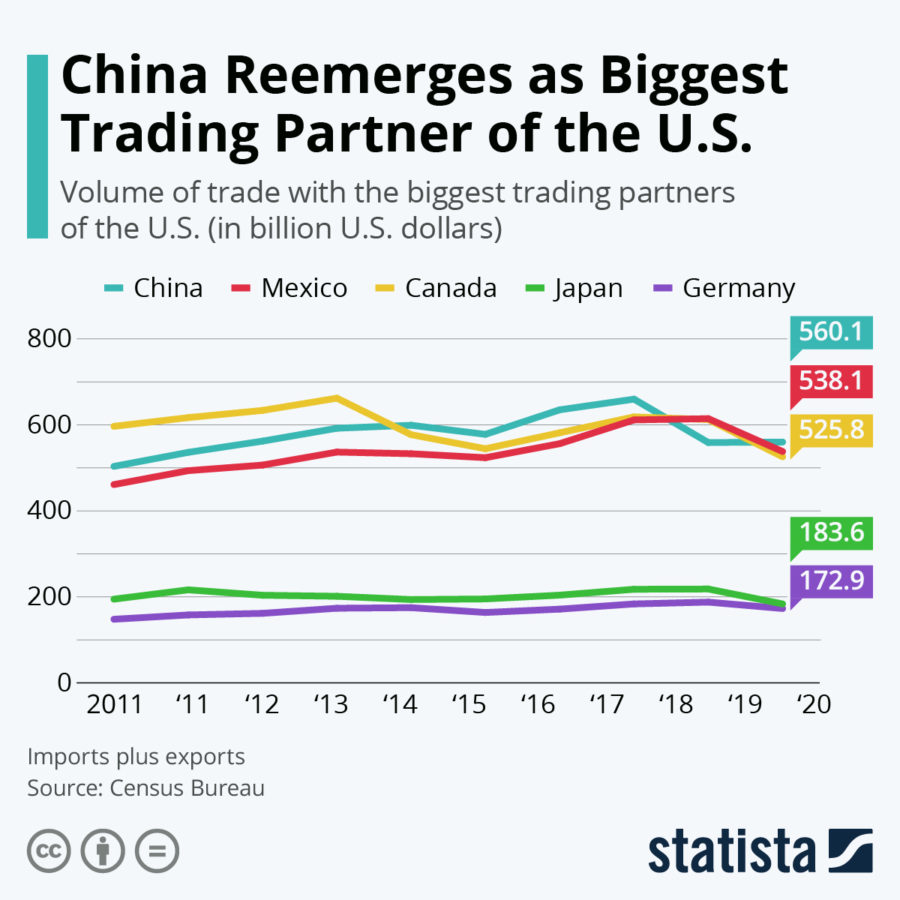

The People’s Bank of China (PBOC) manages the worth of its currency, in this yuan vs dollar competition, by keeping its value fastened to a plethora of currencies manifesting its trade partners. Like most countries, the basket of Chinese currency is weighted towards its largest trading partner – the United States of America. The PBOC, in August 2015, altered this peg and started using a reference rate that was equivalent to the previous day’s value of yuan. In the yuan vs dollar competition, this move allowed the yuan to be more directed by the market forces.

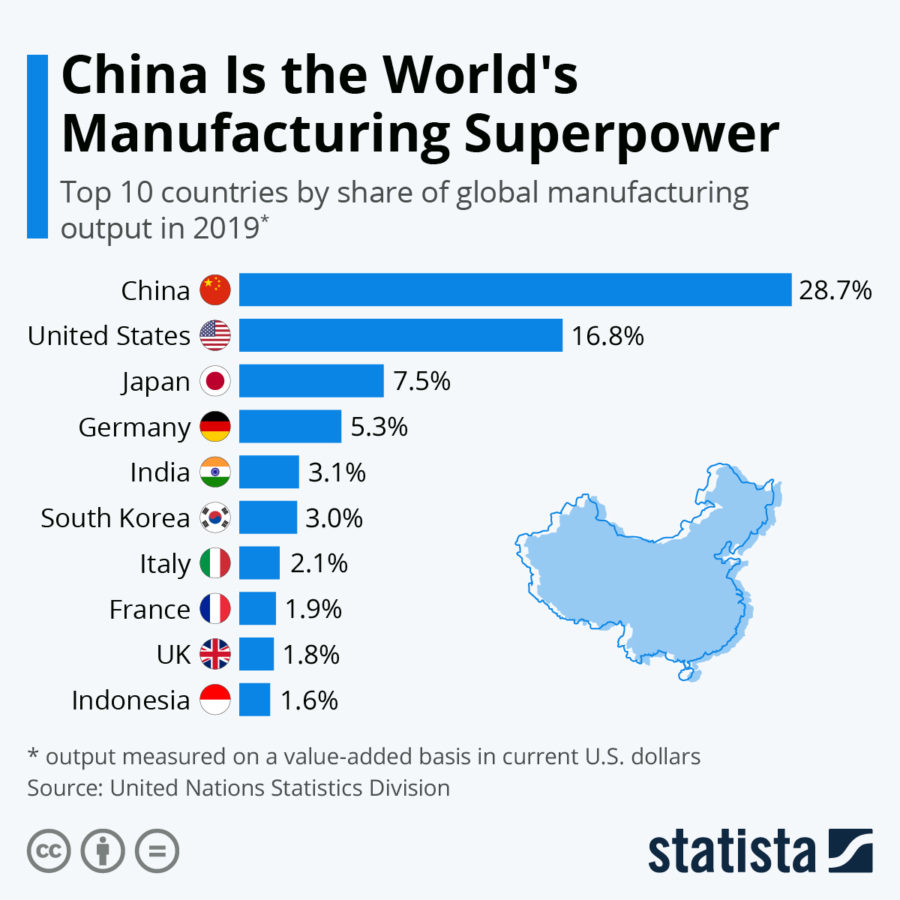

The main source of China’s economic power is its exports to the United States and other states of the globe. Many American companies send raw materials to China because of the cheap labor costs. These goods, when returned to the US in the form of the finished products, are deemed as imports and earn China huge sums of dollars. As compared to the US, China’s manufacturing industry accounts for 30% of its GDP, whereas the former’s constitute only 11% of the GDP.

Chinese companies deposit these dollars in their local banks and get yuan to reimburse their local workers. Local banks send these dollars to the PBOC which holds them in its reserves of foreign exchange and regularly influences the worth of USD by selling or buying these dollars via foreign currency markets in return for yuan.

This stockpiling of dollars makes China able to reduce the availability of dollars for commerce, putting an ascending pester on the dollar and opposite pressure on its own currency. The country, China, then uses these accumulated dollars to purchase the U.S. treasuries.

Impacts of China’s Currency Devaluation

As of April 2019, China is the second-biggest lender to the United States, just behind Japan and the latter’s debt to the former was $1.07 trillion. That constitutes 15% of the total public debt owned by foreign countries. This situation makes many people anxious as they think that it gives China leverage over US fiscal policy. They also maintain that the US treasury could be vulnerable to China if, in case, she starts selling American treasury holdings. This would prove disastrous for the US economy.

China helped to keep the US interest rates low by buying the treasury but if she halts this purchasing, the interest rates could go the other way around. This is not even in the best interest of China as it would spur recession in the United States and the US consumers would not be able to buy the Chinese exports.

The leverage of China in terms of cheap labor and production cost has hit the US business companies worst. Many American companies had to outsource their jobs to China and India to reduce their cost and compete with Chinese products. This has resulted in an overall decline of manufacturing jobs in the United States to about 30%. About 1,800 factories have disappeared only between 2016 and 2018.

Developing countries like Pakistan cannot afford currency devaluation because weak currency would further increase the amount of loan the country has to pay to the international monetary institutions and other lenders. This is clearly evident from the recent increasing inflation in Pakistan that whenever the rate of the dollar increases the sum of the loans on Pakistan also increases. This is one of the major reasons that we often hear that the IMF (International Monetary Fund) is behind the dollar plunge in Pakistan.

The panacea for the weak economies in all the Third World countries, including Pakistan, lies in increased industrialization just like China elevated its economy. Otherwise, the only beneficiary of their cheap labor and minerals will be the developed countries like the USA and the UK. Although, the charges of accusing China have been dropped by the United States yet both countries need to adopt a prudent approach in terms of bilateral relations.

Any development between the two affects the whole world in every dimension. So, both the powers must go towards paving a way for peaceful coexistence instead of engaging each other in different sorts of war fronts. Being superpowers, they should collaborate to eradicate terrorism and poverty instead of making the world go on the verge of collapse.

If you want to submit your articles and/or research papers, please check the Submissions page.

The views and opinions expressed in this article/paper are the author’s own and do not necessarily reflect the editorial position of Paradigm Shift.